louisiana estate tax return

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one.

Is Estate Tax Owed On Living Trust Assets Youtube

Who must file an estate transfer tax return.

. Free Tax Power of Attorney Louisiana Form. Direct Deposit is available for Louisiana. BATON ROUGE Louisiana taxpayers have until Oct.

How is estate transfer tax calculated. Louisiana Department of Revenue Taxpayer Services Division P. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms.

Simply select the form or package of. File your taxes online. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

The types of taxes a deceased taxpayers. Declaration of Estimated Income Taxes. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the federal internal revenue code.

Returns and payments are due. Preparation of a state tax return for Louisiana is available for 2995. The estate would then be given a federal tax credit for the.

Taxpayers must make a declaration of estimated income tax and pay estimated tax payments if their estimated Louisiana income tax after credits and taxes withheld is. Louisiana Department of Revenue Taxpayer Services Division P. Sales Taxes - Louisiana Department of Revenue.

Check on the status of your individual income refund. But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Generally the estate tax return is due nine months after the date of death.

The estate transfer tax is calculated by determining a ratio of assets included in. Fiduciary Income Tax Who Must File. 13 rows The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022.

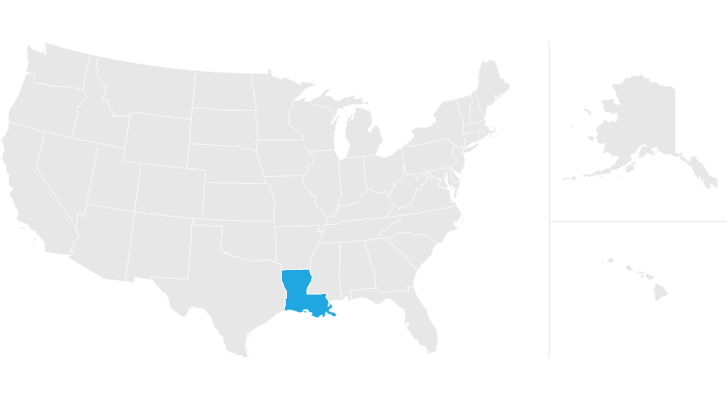

The Louisiana Department of. Louisiana does not levy an estate tax against its residents. This ratio is applied.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. File Pay Online.

Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. 6 2022 to claim millions of dollars in state income tax refunds before they become unclaimed property. E-File is available for Louisiana.

Louisiana Citizens Insurance Tax.

Form R 3318 Inheritance And Estate Transfer Tax Return

Louisiana Estate Tax Planning Vicknair Law Firm

Filing Louisiana State Tax Things To Know Credit Karma

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Complete Guide To Probate In Louisiana

Roles Of Estate Administrators And Executors In Louisiana Scott Vicknair Law

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana File And Pay Online Louisiana Department Of Revenue

Attorney At Law Do I Need To File An Estate Tax Return Tbr News Media

![]()

Louisiana Succession Taxes Scott Vicknair Law

How Many People Pay The Estate Tax Tax Policy Center

Louisiana Inheritance Tax Estate Tax And Gift Tax

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

State Estate And Inheritance Taxes Itep

Louisiana Succession Taxes Scott Vicknair Law

Forms Louisiana Department Of Revenue

How Do State And Local Property Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-924525450-3309b862fb4542cabd4ef8b759b02d5d.jpg)